Linear Regression Part 1 - Linear Models

Introduction

Linear Regression is the linear approach to modeling the relationship between a quantitative response () and one or more explanatory variables (); also known as Response and Features, respectively.

This post focuses on Simple and Multiple Linear Model, also covering Flexible Linear Model (higher order and interaction terms).

The code can be found in this Notebook.

Let’s load the data and necessary libraries. The toy dataset used in this example contain information on house prices and its characteristics, such as Neighborhood, square footage, # of bedrooms and bathrooms.

import pandas as pd

import numpy as np

import seaborn as sns

import matplotlib.pyplot as plt

%matplotlib inline

df = pd.read_csv('house_prices.csv')

df.drop(columns='house_id', inplace=True)

df.head(3)

| neighborhood | area | bedrooms | bathrooms | style | price | |

|---|---|---|---|---|---|---|

| 0 | B | 1188 | 3 | 2 | ranch | 598291 |

| 1 | B | 3512 | 5 | 3 | victorian | 1744259 |

| 2 | B | 1134 | 3 | 2 | ranch | 571669 |

Correlation Coefficient,

Measure of strength and direction of linear relationship between a pair of variables. Also know as Pearson’s correlation coefficient.

- Value varies between [-1, 1], representing negative and positive linear relationship

- Strength:

- : Weak correlation

- : Moderate correlation

- : Strong correlation

df.corr().style.background_gradient(cmap='Wistia')

| area | bedrooms | bathrooms | price | |

|---|---|---|---|---|

| area | 1 | 0.901623 | 0.891481 | 0.823454 |

| bedrooms | 0.901623 | 1 | 0.972768 | 0.743435 |

| bathrooms | 0.891481 | 0.972768 | 1 | 0.735851 |

| price | 0.823454 | 0.743435 | 0.735851 | 1 |

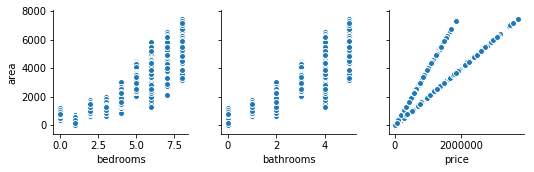

A scatter plot between two variables is a good way to visually inspect correlation:

sns.pairplot(data=df,y_vars='area', x_vars=['bedrooms', 'bathrooms','price']);

Ordinary Least Squares Algorithm

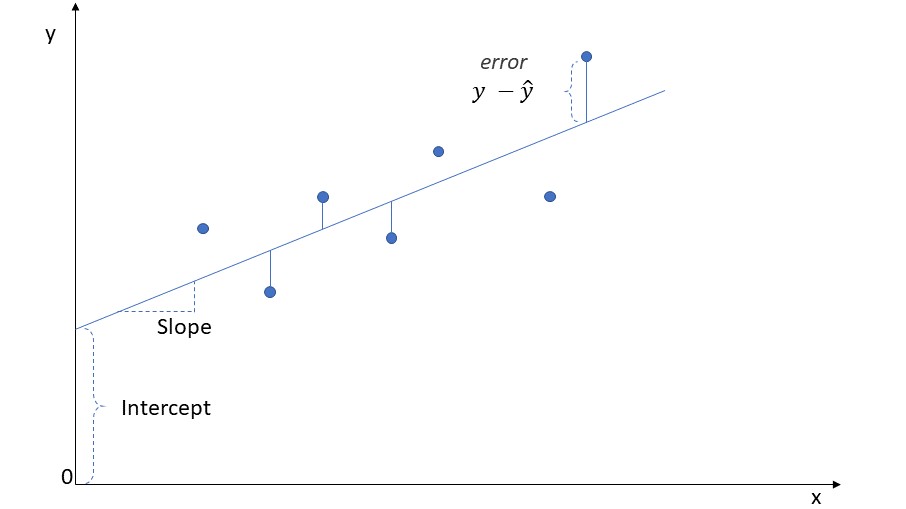

The main algorithm used to find the line that best fit the data. It minimizes the sum of squared vertical distance between the fitted line and the actual points.

Basically, it tries to minimize the error.

A Simple Linear Regression Model can be written as:

Where,

- : predicted response

- : intercept. Height of the fitted line when . That is, no influence from explanatory variables

- : coefficient. The slope of the fitted line. Represents the weight of the explanatory variable

The Statsmodels package is a good way to obtain linear models, providing pretty and informative results, such as intercept, coefficients, p-value, and R-squared.

Note 1:

Statsmodelsrequires us to manually create an intercept = 1 so the algorithm can use it. Otherwise, the intercept is fixed at 0.

Note2: Different than

Scikit-Learn,Statsmodelsrequires the response variable as the first parameter.

import statsmodels.api as sm

df['intercept'] = 1

# Note how Statsmodels uses the order (y, X)

model = sm.OLS(df.price, df[['intercept', 'area']])

results = model.fit()

results.summary2()

| Model: | OLS | Adj. R-squared: | 0.678 |

| Dependent Variable: | price | AIC: | 169038.2643 |

| Date: | 2019-04-03 16:30 | BIC: | 169051.6726 |

| No. Observations: | 6028 | Log-Likelihood: | -84517. |

| Df Model: | 1 | F-statistic: | 1.269e+04 |

| Df Residuals: | 6026 | Prob (F-statistic): | 0.00 |

| R-squared: | 0.678 | Scale: | 8.8297e+10 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | 9587.8878 | 7637.4788 | 1.2554 | 0.2094 | -5384.3028 | 24560.0784 |

| area | 348.4664 | 3.0930 | 112.6619 | 0.0000 | 342.4029 | 354.5298 |

Interpretation

In this simple example, we are tying to predict house prices as a function of their area (in square feet).

-

intercept: it means the starting point for every house is 9,588 price unit

-

coefficient: being a quantitative variable, it means that for every 1 area unit increase, we expect 345.5 increase in the price unit, on top of the intercept.

-

p-value: represents if a specific variable is significant in the model. If p-value > , then we can discard that variable from the model without significantly impacting its predictive power.

It always tests the following Hypothesis:

- R-squared: it is a metric of model performance (coefficient of determination). Represents the amount of observations that can be “explained” by the model. In this case, 0.678 or 67.8%.

- It is calculated as the square of the Correlation Coefficient, hence its value varies between [0, 1].

Note: R-squared is a metric only capturing linear relationship. Better and more robust forms of model evaluation are covered in Part 3 of this Linear Regression series, such as accuracy, precision, and recall.

Multiple Linear Regression

But it is also possible to incorporate more than just one explanatory variable in our linear model:

Let’s fit a linear model using all quantitative variables available:

df['intercept'] = 1

# Note how Statsmodels uses the order (y, X)

model = sm.OLS(df.price, df[['intercept', 'area','bedrooms','bathrooms']])

results = model.fit()

results.summary2()

| Model: | OLS | Adj. R-squared: | 0.678 |

| Dependent Variable: | price | AIC: | 169041.9009 |

| Date: | 2019-04-03 16:30 | BIC: | 169068.7176 |

| No. Observations: | 6028 | Log-Likelihood: | -84517. |

| Df Model: | 3 | F-statistic: | 4230. |

| Df Residuals: | 6024 | Prob (F-statistic): | 0.00 |

| R-squared: | 0.678 | Scale: | 8.8321e+10 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | 10072.1070 | 10361.2322 | 0.9721 | 0.3310 | -10239.6160 | 30383.8301 |

| area | 345.9110 | 7.2272 | 47.8627 | 0.0000 | 331.7432 | 360.0788 |

| bedrooms | -2925.8063 | 10255.2414 | -0.2853 | 0.7754 | -23029.7495 | 17178.1369 |

| bathrooms | 7345.3917 | 14268.9227 | 0.5148 | 0.6067 | -20626.8031 | 35317.5865 |

Interpretation

Since the p-value of bedrooms and bathrooms is greater than (0.05), it means these variables are not significant in the model. Which explains why the R-squared didn’t improve after adding more features.

As a matter of fact, it is all about multicollinearity: as it happens, there is an intrinsic correlation between these explanatory variables.

You would expect a house with more bedrooms and bathrooms to have a higher square footage!

It is also the reason behind the unexpected flipped sign for the bedrooms coefficient.

Just as well, you would expect a house with more bedrooms to become more and more expensive; not cheaper!

This and other potential modeling problems will be covered in more details later, in Part 2. But basically, in situations like this, we would remove the correlated features from our model, retaining only the “most important one”.

The “most important one” can be understood as:

- A specific variable we have particular interest in understanding/capturing

- A more granular variable, allowing for a better representation of the characteristics our model is trying to capture

- A variable easier to obtain

In this case, let’s discard the others quantitative variables and use only area as predictor in the model:

df['intercept'] = 1

# Note how Statsmodels uses the order (y, X)

model = sm.OLS(df.price, df[['intercept', 'area']])

results = model.fit()

results.summary2()

| Model: | OLS | Adj. R-squared: | 0.678 |

| Dependent Variable: | price | AIC: | 169038.2643 |

| Date: | 2019-04-03 16:30 | BIC: | 169051.6726 |

| No. Observations: | 6028 | Log-Likelihood: | -84517. |

| Df Model: | 1 | F-statistic: | 1.269e+04 |

| Df Residuals: | 6026 | Prob (F-statistic): | 0.00 |

| R-squared: | 0.678 | Scale: | 8.8297e+10 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | 9587.8878 | 7637.4788 | 1.2554 | 0.2094 | -5384.3028 | 24560.0784 |

| area | 348.4664 | 3.0930 | 112.6619 | 0.0000 | 342.4029 | 354.5298 |

Interpretation

The adjusted R-squared remained at 0.678, indicating we didn’t lose much by dropping bedrooms and bathrooms from our model.

So, considering the quantitative variables available, we should only use area.

But what about the categorical variables?

Working with Categorical Data

So far we have only worked with quantitative variables in our examples. But it is also possible to work with Categorical data, such as Neighborhood or Style.

We can use Hot-One encoding, creating new dummy variables receiving value of 1 if the category is true, or 0 otherwise.

We can easily implement this by using the pandas.get_dummies function.

Note: we use the

pd.get_dummiesfunction inside thedf.join, in order to add the created columns to the already existing dataframe.

df = df.join(pd.get_dummies(df.neighborhood, prefix='neighb'))

df = df.join(pd.get_dummies(df['style'], prefix='style'))

df.head(2)

| neighborhood | area | bedrooms | bathrooms | style | price | intercept | neighb_A | neighb_B | neighb_C | style_lodge | style_ranch | style_victorian | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | B | 1188 | 3 | 2 | ranch | 598291 | 1 | 0 | 1 | 0 | 0 | 1 | 0 |

| 1 | B | 3512 | 5 | 3 | victorian | 1744259 | 1 | 0 | 1 | 0 | 0 | 0 | 1 |

But before we can incorporate the categorical data in the model, it is necessary to make sure the selected features are Full Rank. That is, all explanatory variables are linearly independent.

If a dummy variable holds the value 1, it specifies the value for the categorical variable. But we can just as easily identify it if all other dummy variables are 0.

Therefore, all we need to do is leave one of the dummy variables out of the model - for each group of categorical variable. This “left out” variable will be the baseline for comparison among the others from the same category.

Let’s use only Neighborhood (A, B, C) and Style (Victorian, Lodge, Ranch) in our model:

# neighborhood Baseline = A

# style Baseline = Victorian

feature_list = ['intercept', 'neighb_B', 'neighb_C', 'style_lodge','style_ranch']

# Note how Statsmodels uses the order (y, X)

model = sm.OLS(df.price, df[feature_list])

results = model.fit()

results.summary2()

| Model: | OLS | Adj. R-squared: | 0.584 |

| Dependent Variable: | price | AIC: | 170590.6058 |

| Date: | 2019-04-03 16:30 | BIC: | 170624.1267 |

| No. Observations: | 6028 | Log-Likelihood: | -85290. |

| Df Model: | 4 | F-statistic: | 2113. |

| Df Residuals: | 6023 | Prob (F-statistic): | 0.00 |

| R-squared: | 0.584 | Scale: | 1.1417e+11 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | 836696.6000 | 8960.8404 | 93.3726 | 0.0000 | 819130.1455 | 854263.0546 |

| neighb_B | 524695.6439 | 10388.4835 | 50.5074 | 0.0000 | 504330.4978 | 545060.7899 |

| neighb_C | -6685.7296 | 11272.2342 | -0.5931 | 0.5531 | -28783.3433 | 15411.8841 |

| style_lodge | -737284.1846 | 11446.1540 | -64.4133 | 0.0000 | -759722.7434 | -714845.6259 |

| style_ranch | -473375.7836 | 10072.6387 | -46.9962 | 0.0000 | -493121.7607 | -453629.8065 |

Interpretation

Using both categorical data at the same time, our model resulted in an R-squared of 0.584. Which is less than obtained before with quantitative data… but it still means there is some explanatory power to these categorical variables.

All variables seem to be significant, with p-value < . Except for Neighborhood C.

This means neighb_C is not statistically significant in comparison to the baseline, neighb_A.

To interpret the significance between a dummy and the other variables, we look at the confidence interval (given by [0.025 and 0.975]): if they do not overlap, then it is considered significant. In this case, neighb_C is significant to the model, just not when compared to the baseline… suggesting that Neighborhood A shares the same characteristics of Neighborhood C.

-

intercept: represents the impact of the Baselines. In this case, we expect a Victorian house located in Neighborhood A to cost 836,696 price unit.

-

Coefficients: since we only have dummy variables, they are interpreted against their own category baseline

- neighb_B: we predict a house in Neighborhood B to cost 524,695 more than in Neighborhood A (baseline). For a Victorian house, it would cost 836,696 + 524,695 = 1,361,391 price unit.

- neighb_C: since its p-value > , it is not significant compared to the baseline - so we ignore the interpretation of this coefficient

- style_lodge: we predict a Lodge house to cost 737,284 less than a Victorian (baseline). In Neighborhood A, it would cost 836,696 - 737,284 = 99,412 price unit

- style_ranch: we predict a Ranch to cost 473,375 less than a Victorian (baseline). In Neighborhood A, it would cost 836,696 - 473,375 = 363,321 price unit

Putting it all together

Now that we covered how to work with and interpret quantitative and categorical variables, it is time to put it all together:

Note: we leave Neighborhood C out of the model, since our previous regression - using only categorical variables - showed it to be insignificant.

In this case, Neighborhood A is no longer the Baseline and needs to be explicitly added to the model:

# style Baseline = Victorian

feature_list = ['intercept', 'area', 'neighb_A', 'neighb_B', 'style_lodge', 'style_ranch']

# Note how Statsmodels uses the order (y, X)

model = sm.OLS(df.price, df[feature_list])

results = model.fit()

results.summary2()

| Model: | OLS | Adj. R-squared: | 0.919 |

| Dependent Variable: | price | AIC: | 160707.1908 |

| Date: | 2019-04-03 16:30 | BIC: | 160747.4158 |

| No. Observations: | 6028 | Log-Likelihood: | -80348. |

| Df Model: | 5 | F-statistic: | 1.372e+04 |

| Df Residuals: | 6022 | Prob (F-statistic): | 0.00 |

| R-squared: | 0.919 | Scale: | 2.2153e+10 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | -204570.6449 | 7699.7035 | -26.5686 | 0.0000 | -219664.8204 | -189476.4695 |

| area | 348.7375 | 2.2047 | 158.1766 | 0.0000 | 344.4155 | 353.0596 |

| neighb_A | -194.2464 | 4965.4594 | -0.0391 | 0.9688 | -9928.3245 | 9539.8317 |

| neighb_B | 524266.5778 | 4687.4845 | 111.8439 | 0.0000 | 515077.4301 | 533455.7254 |

| style_lodge | 6262.7365 | 6893.2931 | 0.9085 | 0.3636 | -7250.5858 | 19776.0588 |

| style_ranch | 4288.0333 | 5367.0317 | 0.7990 | 0.4243 | -6233.2702 | 14809.3368 |

Looks like Neighborhood A is not significant to the model. Let’s remove it and interpret the results again:

# style Baseline = Victorian

feature_list = ['intercept', 'area', 'neighb_B', 'style_lodge', 'style_ranch']

# Note how Statsmodels uses the order (y, X)

model = sm.OLS(df.price, df[feature_list])

results = model.fit()

results.summary2()

| Model: | OLS | Adj. R-squared: | 0.919 |

| Dependent Variable: | price | AIC: | 160705.1923 |

| Date: | 2019-04-03 16:30 | BIC: | 160738.7132 |

| No. Observations: | 6028 | Log-Likelihood: | -80348. |

| Df Model: | 4 | F-statistic: | 1.715e+04 |

| Df Residuals: | 6023 | Prob (F-statistic): | 0.00 |

| R-squared: | 0.919 | Scale: | 2.2149e+10 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | -204669.1638 | 7275.5954 | -28.1309 | 0.0000 | -218931.9350 | -190406.3926 |

| area | 348.7368 | 2.2045 | 158.1954 | 0.0000 | 344.4152 | 353.0583 |

| neighb_B | 524367.7695 | 3908.8100 | 134.1502 | 0.0000 | 516705.1029 | 532030.4361 |

| style_lodge | 6259.1344 | 6892.1067 | 0.9082 | 0.3638 | -7251.8617 | 19770.1304 |

| style_ranch | 4286.9410 | 5366.5142 | 0.7988 | 0.4244 | -6233.3477 | 14807.2296 |

Looking at the high p-values of style_lodge and style_ranch, they do not seem to be significant in our model.

Let’s regress our model again, removing style_lodge.

Note: since we are removing Lodge, Victorian style no longer is the baseline, hence we have to explicitly add it to the model

feature_list = ['intercept', 'area', 'neighb_B', 'style_victorian', 'style_ranch']

# Note how Statsmodels uses the order (y, X)

model = sm.OLS(df.price, df[feature_list])

results = model.fit()

results.summary2()

| Model: | OLS | Adj. R-squared: | 0.919 |

| Dependent Variable: | price | AIC: | 160705.1923 |

| Date: | 2019-04-03 16:30 | BIC: | 160738.7132 |

| No. Observations: | 6028 | Log-Likelihood: | -80348. |

| Df Model: | 4 | F-statistic: | 1.715e+04 |

| Df Residuals: | 6023 | Prob (F-statistic): | 0.00 |

| R-squared: | 0.919 | Scale: | 2.2149e+10 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | -198410.0294 | 4886.8434 | -40.6009 | 0.0000 | -207989.9917 | -188830.0672 |

| area | 348.7368 | 2.2045 | 158.1954 | 0.0000 | 344.4152 | 353.0583 |

| neighb_B | 524367.7695 | 3908.8100 | 134.1502 | 0.0000 | 516705.1029 | 532030.4361 |

| style_victorian | -6259.1344 | 6892.1067 | -0.9082 | 0.3638 | -19770.1304 | 7251.8617 |

| style_ranch | -1972.1934 | 5756.6924 | -0.3426 | 0.7319 | -13257.3710 | 9312.9843 |

Once again, neither Victorian nor Ranch proved to be significant in the model.

Let’s remove style_ranch:

feature_list = ['intercept', 'area', 'neighb_B', 'style_victorian']

# Note how Statsmodels uses the order (y, X)

model = sm.OLS(df.price, df[feature_list])

results = model.fit()

results.summary2()

| Model: | OLS | Adj. R-squared: | 0.919 |

| Dependent Variable: | price | AIC: | 160703.3098 |

| Date: | 2019-04-03 16:30 | BIC: | 160730.1265 |

| No. Observations: | 6028 | Log-Likelihood: | -80348. |

| Df Model: | 3 | F-statistic: | 2.287e+04 |

| Df Residuals: | 6024 | Prob (F-statistic): | 0.00 |

| R-squared: | 0.919 | Scale: | 2.2146e+10 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | -199292.0351 | 4153.3840 | -47.9831 | 0.0000 | -207434.1541 | -191149.9162 |

| area | 348.5163 | 2.1083 | 165.3055 | 0.0000 | 344.3833 | 352.6494 |

| neighb_B | 524359.1981 | 3908.4435 | 134.1606 | 0.0000 | 516697.2501 | 532021.1461 |

| style_victorian | -4716.5525 | 5217.5622 | -0.9040 | 0.3660 | -14944.8416 | 5511.7367 |

Looks like the house style is not significant at all in our model.

Let’s also remove Style Victorian from our explanatory variables:

feature_list = ['intercept', 'area', 'neighb_B']

# Note how Statsmodels uses the order (y, X)

model = sm.OLS(df.price, df[feature_list])

results = model.fit()

results.summary2()

| Model: | OLS | Adj. R-squared: | 0.919 |

| Dependent Variable: | price | AIC: | 160702.1274 |

| Date: | 2019-04-03 16:30 | BIC: | 160722.2399 |

| No. Observations: | 6028 | Log-Likelihood: | -80348. |

| Df Model: | 2 | F-statistic: | 3.430e+04 |

| Df Residuals: | 6025 | Prob (F-statistic): | 0.00 |

| R-squared: | 0.919 | Scale: | 2.2146e+10 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | -198881.7929 | 4128.4536 | -48.1734 | 0.0000 | -206975.0391 | -190788.5467 |

| area | 347.2235 | 1.5490 | 224.1543 | 0.0000 | 344.1868 | 350.2602 |

| neighb_B | 524377.5839 | 3908.3313 | 134.1692 | 0.0000 | 516715.8561 | 532039.3117 |

Interpretation

Finally, all features are significant (p-value < ).

Interestingly, the adjusted R-squared never changed through the process of eliminating insignificant explanatory variables, meaning these final ones are indeed the most important ones for predicting house price.

Basically, it means that for every 1 area unit increase, we expect an increase of 347 price unit. If a house is situated in Neighborhood B, we expect it to cost, on average, 524,377 more than in Neighborhoods A or C.

Even though the intercept has a negative value, this equation resulted in the best predicting performance so far (adjusted R-squared of 0.919). One can argue that every house - even the smallest one - still have area greater than 0. For houses in Neighborhood A and C with square footage greater than 580, we start to predict positive values for price.

Flexible Linear Models

The linear model is also capable of incorporating non-linear relationships between the explanatory variables and the response, such as: Higher Order and Interaction.

Higher Order

Whenever there is a clear curve-like pattern between the pair plot of an explanatory variable and the response .

- the higher order should always be the amount of peaks + 1. For example, in a U shaped pair plot, there is 1 peak, hence the feature should be of order 2:

- whenever using higher order terms in the model, it is also necessary to include the lower order terms. In this example of order 2, we would have the following terms:

Interaction

Whenever the relationship between a feature () and the response () change according to another feature ()

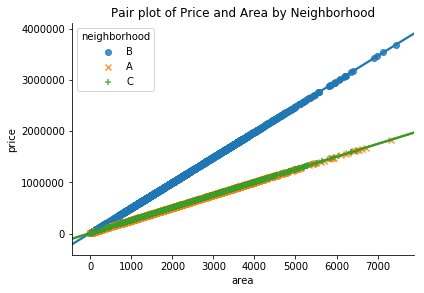

- the need for an interaction term can be visually investigated by adding the hue parameter (color) to the typical pair plot. If the relationship of and have different slopes based on , then we should add the interaction term:

- Similarly to higher order, if implemented in the model, it is also necessary to add the “lower” terms, so the model would look like this:

Downside

But there is a caveat: while the prediction power of the linear model improves by adding flexibility (higher order and interaction), it loses the ease of interpretation of the coefficients.

It is no longer straightforward - as seen in the previous models - to interpret the impact of quantitative or categorical variables. Any change in the explanatory variable would be reflected in the simple term, as well as the higher order one, .

Enter the trade-off of linear models: flexible terms might improve model performance, but at the cost of interpretability.

If you are interested in understanding the impact of each variable over the response, it is recommended to avoid using flexible terms.

… and if you are only interested in making accurate predictions, than Linear Models would not be your best bet anyway!

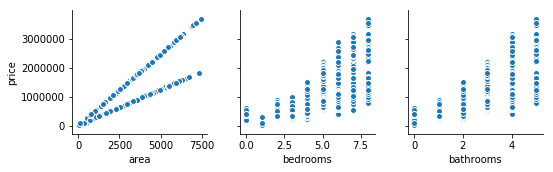

sns.pairplot(data=df, y_vars='price', x_vars=['area', 'bedrooms','bathrooms']);

The relationship between the features and the response does not present any curves. Hence, there is no base to implement a higher order term in the model.

# Pair plot by Neighborhood

sns.lmplot(x='area', y='price', data=df, hue='neighborhood', size=4,

markers=['o','x','+'], legend_out=False, aspect=1.5)

plt.title('Pair plot of Price and Area by Neighborhood');

It is clear to see in the image above that the relationship between area and price does vary based on the neighborhood. Which suggests we should add the interaction term.

In this particular case, Neighborhood A and C have the exact same behavior. Therefore, we only need to verify whether the house is located in Neighborhood B or not (using the dummy variable, neighb_B).

# Creating interaction term to be incorporated in the model

df['area_neighb'] = df.area * df.neighb_B

df['intercept'] = 1

features_list = ['intercept', 'area','neighb_B','area_neighb']

model = sm.OLS(df.price, df[features_list])

result = model.fit()

result.summary2()

| Model: | OLS | Adj. R-squared: | 1.000 |

| Dependent Variable: | price | AIC: | 71986.6799 |

| Date: | 2019-04-03 16:30 | BIC: | 72013.4966 |

| No. Observations: | 6028 | Log-Likelihood: | -35989. |

| Df Model: | 3 | F-statistic: | 6.131e+10 |

| Df Residuals: | 6024 | Prob (F-statistic): | 0.00 |

| R-squared: | 1.000 | Scale: | 8986.8 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | 12198.0608 | 3.1492 | 3873.3747 | 0.0000 | 12191.8872 | 12204.2343 |

| area | 248.1610 | 0.0013 | 194094.9191 | 0.0000 | 248.1585 | 248.1635 |

| neighb_B | 132.5642 | 4.9709 | 26.6682 | 0.0000 | 122.8195 | 142.3089 |

| area_neighb | 245.0016 | 0.0020 | 121848.3887 | 0.0000 | 244.9976 | 245.0055 |

Interpretation

Our best model performance, with an impressive adjusted R-squared of 100%. All variables are significant and their signs match the expected direction (positive).

Although the interpretation is not as easy as before, we can still try to make some sense out of it because this is a special case of interaction, involving a binary variable.

- intercept: we expect all houses to have the initial price of 12,198 price unit.

- Coefficients:

- for houses in Neighborhood A and C, we expect the price to increase by 248 price unit for every additional area unit. So, the average price of a house of 120 sqft situated in Neighborhood A or C is:

- for houses in Neighborhood B, we expect the price to increase by 493 (248 + 245) price unit for every additional area unit. There would also be an additional 132 price unit on top of the intercept, independent of the area. So the average price of a house of 120 sqft located in Neighborhood B is:

Conclusion

In this post we reviewed the basics of Linear Regression, covering how to model and interpret the results of Simple and Multiple Linear Models - working with quantitative as well as categorical variables.

We also covered Flexible Linear Models, when to implement them, and the intrinsic trade-off between flexibility and interpretability.

In the next post (Part 2), we will focus on some of the potential modeling problems regarding the basic assumptions required for Regression models, covering some strategies on how to identify and address them. Namely, 1) Linearity, 2) Correlated Errors, 3) Non-constant Variance of Errors, 4) Outliers and Leverage Points, and 5) Multicollinearity.

As always, constructive feedback is appreciated. Feel free to leave any questions/suggestions in the comments section below!